यह देखने के लिए कि हिंदी में दिखता है

अभिमन्यु राणा का व्यक्तिगत ब्लॉग

सोमवार, 16 नवंबर 2015

सोमवार, 20 अप्रैल 2015

Need for land reforms in the Indian agricultural sector - Part 1 - land ceiling

Why do you only rarely meet a rich farmer? Why are our farmers committing suicide? There are a bunch of issues, but in this article we’ll focus on land.

First let me help you develop an understanding into the circumstances prevalent at various times. Decades ago the business of agriculture was devoid of economies of scale. Ploughing was done using bulls, irrigation by monsoon, and harvesting by hand. In this devoid of technology scenario the expenses scaled linearly with land holding size.

In modern times, the business of agriculture has strong economies of scale. Powerful tractors can do dozens of acres a day, canals and tube-wells supply water on demand, and there is scope for using mechanized harvesters. What this means is that today's farming is very much a fit case of scalability = sustainability.

In the times when land ceiling was introduced, the planners were probably blindsided by incoming votes to do some research on where farming as a business/sustenance activity was headed in the future. So they put up a maximum agriculture land holding rule per family. Large landowners as well as farm laborers became equal sized via allotment of lands to the poor and SC/SC communities. Perhaps a combination of fear of old landowners forcefully taking the land back via forced transactions as well as vote bank greed motivated introduction of provisions in the SC/ST act that eliminated the option of an SC/ST selling agricultural land to other castes. What that has ensured is that they almost never get market rates for their land as the eligible buyers know that the seller has limited options.

The impact? With time, business case went out of farming. Farmers who had been laborers had no grip on the business aspects of farming. So when failures came, whether due to droughts, disease or otherwise, they were unprepared for consequences. Given the stratospheric cost of capital in India (read this blog post about cost of capital in India), they were pushed into debt (or should they be called be debt traps?) either at the hands of the local money lender or the banks.

With land holdings this small, there's not even a business case for storage of produce in order to benefit from seasonal rate increases. Same is the situation with food processing units.

To counter this disaster (and also somewhere influenced by leftist ideas) we came up with cooperatives. The idea was good. In fact it was too good. It attracted the politicians, and we all know what came out of it. To this date, to be appointed as a cooperative's board member is a lucrative thing.

The average farm is so small that even with basic mechanization, there is not much work for the whole family, except for during time of harvest. And that is most of the guards outside our offices go all of a sudden. Confirm it with a guard next time you see one.

A more effective way was discovered by some innovative farmers in Punjab. Here a couple would get a divorce, just in order to double their legal land holding, as now the ex-husband and ex-wife are both allowed individual land ceilings. so in order to work towards sustenance, families have to resort to such gimmickry.

Overall, it is shocking to know that what is still over 60% of the country's livelihood makes no business sense. It is also the reason why farmers are fidgety about land acquisition - it's their only asset.

The government has to look at farming as a business and more importantly the farmer as a vulnerable businessman. Policy overhaul is required, especially in terms of land ceiling.

गुरुवार, 12 मार्च 2015

Indian politics - it’s all about the numbers

who cares about ideology anyway?

Indians are famous for number crunching. We are one of the word’s leading factories for producing accountants, engineers, mathematicians etcetera. Good quality too.

So we just couldn’t keep it out of politics, could we.

At some point in it’s history, the Indian politics became less about ideology and values, and more about the winning formula. and Indian Muslims have become the ‘x’ of this formula. You know, most mathematicians use ‘x’ as the variable around which they build an equation. all of us have at some point in school or college struggled with getting to the right equation — i.e. how to place ‘x’ in the equation.

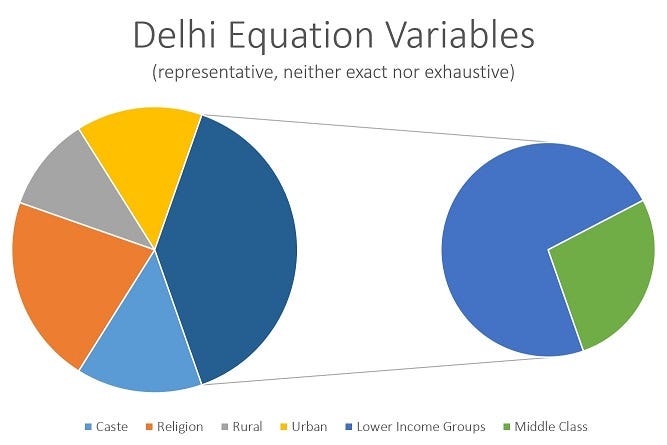

The ‘15 Delhi election results also indicate this. The Aam Aadmi Party has been successful in creating an equation that brings together the middle class (pulled from the BJP pockets), the lower income groups (snatched from the Congress in completion), and the Muslims (again, snatched from the Congress). It is a combination that is unique in 1 sense. They haven’t played the caste card at the state level (must’ve been a factor at constituency level though).

They’ve scored 67/70. ‘x’ + (urban middle class) + [lower income groups] = AAP is a winner.

Another important thing that has started happening is that the ‘x’ has decided to figure out the equation itself. Over the past 1 year, BJP has lost any elections in which the muslim community could figure out who was BJP’s main opponent. Examples here being the 7 LS seats in UP (only ones they didn’t win because either Cong or SP withdrew their candidate as a favor to family), Bihar by-polls (RJD-JDU combine kept it simple) and now Delhi. infact one of the 3 seats that the BJP has won in Delhi is due to the fact that the Muslim vote was split.

One thought that baffles me though is this. Muslims have somehow decided that defeating the BJP is more important than anything else. As far as I can see the past few months have been fairly smooth for one and all. Am sure they have some reason, but the effect is spectacular. Because they tend to vote as a herd, now parties form equations seeing how they can add something to ‘x’ and get it right. This collective purchase will create some interesting combinations in the upcoming elections in UP & Bihar. A political potpourri is coming up.

What the future results will be will depend on one factor. And this factor is the sad outcome of the sad fact that our politics is mathematical. And this factor — the next identifiable vote bank that BJP can loose after some of the urban middle class — is Hindu conservatives. BJP’s attempts to appeal to ‘x’ to somehow get them into their equation AFTER ironically winning the election has created a deep sense of disappointment amongst those who were rooting for fair stuff like a common civil code. This set of people is apart of a larger identifiable set that can be defined as [Hindu moderates, Hindu extremists]. Because BJP is upsetting the master set trying to get something which they can’t get, sooner or later someone is going to come along and attempt to start chewing away at one of the two extremes of this data set.

Looking at the identifiable variables, I’m certain we are not too far from the scenario.

मंगलवार, 30 दिसंबर 2014

Is the RBI throwing a spanner in the government's Make In India mission?

Business needs capital. Most commonly it comes in 2 forms - Equity and Debt. Mostly companies use a combination of both. The manufacturing and infrastructure sectors are mostly heavily loaded towards the debt. Therefore the cost of debt has a deep impact on the cost of capital. Interested readers can go here to read more about calculation of Cost of Capital.

The regulatory framework in India directly controls the cost of capital. RBI sets the Base Rate. This rate dictates the rate at which banks raise capital to give out loans. Add to this overheads and operational costs, and the rate at which the bank gives money to the businesses is a good 3%-5% higher than this.

The direct impact of capital on a business is therefore, easily understood. What most people do not look at is the indirect impact of this factor. For example, a construction company is constructing an office building. It takes a loan from the bank to meet some of it's costs. In a competitive supplier market, the cement vendor gives it a 6 month line of credit, which means that the vendor takes a short loan from the bank for the same. Obviously this also is built into the cost of cement to be borne by the construction company (this explains cash buyer's discount). Therefore cost of goods and services acquired for a project through every vendor as well as direct investments are all impacted by lending rates.

The finished good, in this case an office or a house, is also purchased via the finance route. In case it is a small product like toothpaste, the stockist uses financing to maintain supply.

The same goods end up getting financed more than once, therefore on a project, the cost of capital goes up, even beyond the interest rate from the bank.

Why is the RBI keeping the lending rates high then, you may ask. It definitely seems to be a driver of inflation if it can raise the cost of getting the toothpaste to your toothbrush. Even our Finance Minister has more than once asked him to lower it. The answer, ironically, is inflation itself (though personally I think Mr. Rajan's intentions need to be questioned)! The prevailing wisdom is that inflation can be brought down by increasing rates. If you ask me, it's silly. and the Chinese agree with me. Below are graphs showing the Prime Lending Rates vs Inflation rates in China and India over the last 1 year. You can see that the Chinese have drastically lowered their rates in order to boost their economy. India seems to be napping. Dont ask my why, ask UPA appointed, imported from America, RBI governor Mr. Raghuram Rajan.

A high interest rate regime might work in an economy like North Korea, but it kills anyone in the present world. The first thought might be that it impacts the exporters. They will have to compete with the Chinese (much lower interest cost) and others with a business handicap (explains shrinking manufacturing sector in India). Good observation. But it also impacts manufacturing activities means for internal consumption. Here's how.

Governments usually levy an import duty on goods to protect the local industry. In rare cases outright anti-dumping duties are also levied. These trade barriers are hotly contested by other economies, and many times retaliatory duties from the other side impact some other industry. So there is a limit to protection one can get. A country with a lower cost of capital, therefore can not only kill India's export competitiveness, but also it's internal consumption manufacturing.

Established companies with existing manufacturing bases can still compete somehow with short term discounting, as well as leveraging reputation and relationships. But any entrepreneurs can kiss their chances of establishing themselves goodbye.

The big picture: The biggest impediment to our new government's Make In India plan is the reserve bank of India itself!

I hope the government is able to get the RBI to come around to a saner view and give the economy a chance to reflect the confidence the people have shown in the new team that they have elected with such a resounding mandate.

By the way, here is a nifty tool from Harvard Business School that lets you plug in rates and calculate cost of capital for your business

The regulatory framework in India directly controls the cost of capital. RBI sets the Base Rate. This rate dictates the rate at which banks raise capital to give out loans. Add to this overheads and operational costs, and the rate at which the bank gives money to the businesses is a good 3%-5% higher than this.

The direct impact of capital on a business is therefore, easily understood. What most people do not look at is the indirect impact of this factor. For example, a construction company is constructing an office building. It takes a loan from the bank to meet some of it's costs. In a competitive supplier market, the cement vendor gives it a 6 month line of credit, which means that the vendor takes a short loan from the bank for the same. Obviously this also is built into the cost of cement to be borne by the construction company (this explains cash buyer's discount). Therefore cost of goods and services acquired for a project through every vendor as well as direct investments are all impacted by lending rates.

The finished good, in this case an office or a house, is also purchased via the finance route. In case it is a small product like toothpaste, the stockist uses financing to maintain supply.

The same goods end up getting financed more than once, therefore on a project, the cost of capital goes up, even beyond the interest rate from the bank.

Why is the RBI keeping the lending rates high then, you may ask. It definitely seems to be a driver of inflation if it can raise the cost of getting the toothpaste to your toothbrush. Even our Finance Minister has more than once asked him to lower it. The answer, ironically, is inflation itself (though personally I think Mr. Rajan's intentions need to be questioned)! The prevailing wisdom is that inflation can be brought down by increasing rates. If you ask me, it's silly. and the Chinese agree with me. Below are graphs showing the Prime Lending Rates vs Inflation rates in China and India over the last 1 year. You can see that the Chinese have drastically lowered their rates in order to boost their economy. India seems to be napping. Dont ask my why, ask UPA appointed, imported from America, RBI governor Mr. Raghuram Rajan.

|

| Source: http://www.tradingeconomics.com/ |

|

| Source: http://www.tradingeconomics.com/ |

A high interest rate regime might work in an economy like North Korea, but it kills anyone in the present world. The first thought might be that it impacts the exporters. They will have to compete with the Chinese (much lower interest cost) and others with a business handicap (explains shrinking manufacturing sector in India). Good observation. But it also impacts manufacturing activities means for internal consumption. Here's how.

Governments usually levy an import duty on goods to protect the local industry. In rare cases outright anti-dumping duties are also levied. These trade barriers are hotly contested by other economies, and many times retaliatory duties from the other side impact some other industry. So there is a limit to protection one can get. A country with a lower cost of capital, therefore can not only kill India's export competitiveness, but also it's internal consumption manufacturing.

Established companies with existing manufacturing bases can still compete somehow with short term discounting, as well as leveraging reputation and relationships. But any entrepreneurs can kiss their chances of establishing themselves goodbye.

The big picture: The biggest impediment to our new government's Make In India plan is the reserve bank of India itself!

I hope the government is able to get the RBI to come around to a saner view and give the economy a chance to reflect the confidence the people have shown in the new team that they have elected with such a resounding mandate.

By the way, here is a nifty tool from Harvard Business School that lets you plug in rates and calculate cost of capital for your business

सदस्यता लें

संदेश (Atom)